About INVL Asset Management

INVL Asset Management is the leading alternative asset manager in the Baltic States. We are part of the Invalda INVL Group, which has been operating for over 30 years.

With our one of the most experienced private equity teams in the region, we successfully manage products that vary in size, region of operation and specifics of the companies we invest in. Our operating and investment region covers the Baltic States and emerging Europe. This is the region where we can create the most value, because it is where we have the most experience, expertise and a wide network of partners.

We aim to deliver the best risk-return ratio for investors and a positive economic impact in the regions where we operate. We specialise in private equity and other alternative markets. We aim to be the best investment performer in each asset class. We are constantly expanding and updating our portfolio of funds under management. For more information, see “Investments”.

Our values

Client focus

Clients and their investment needs are always at the centre of our attention. Our team of professionals strives to maximally satisfy clients' needs and get the very best results.

Responsible decisions

In working to create value for investors and society, we take responsibility for our decisions and the results. We weigh the risks and act with professionalism and integrity.

Embracing change

We see changes not as difficulties but as opportunities to grow and try new things. We’re open to change and quick to adapt. We’re not afraid of challenges or complex investments.

Being open

We promote a culture of openness on our team and with investors and business partners. We value mutual trust, transparency and collaboration. We’re open to new ideas and to partnerships that create value.

About INVALDA INVL group

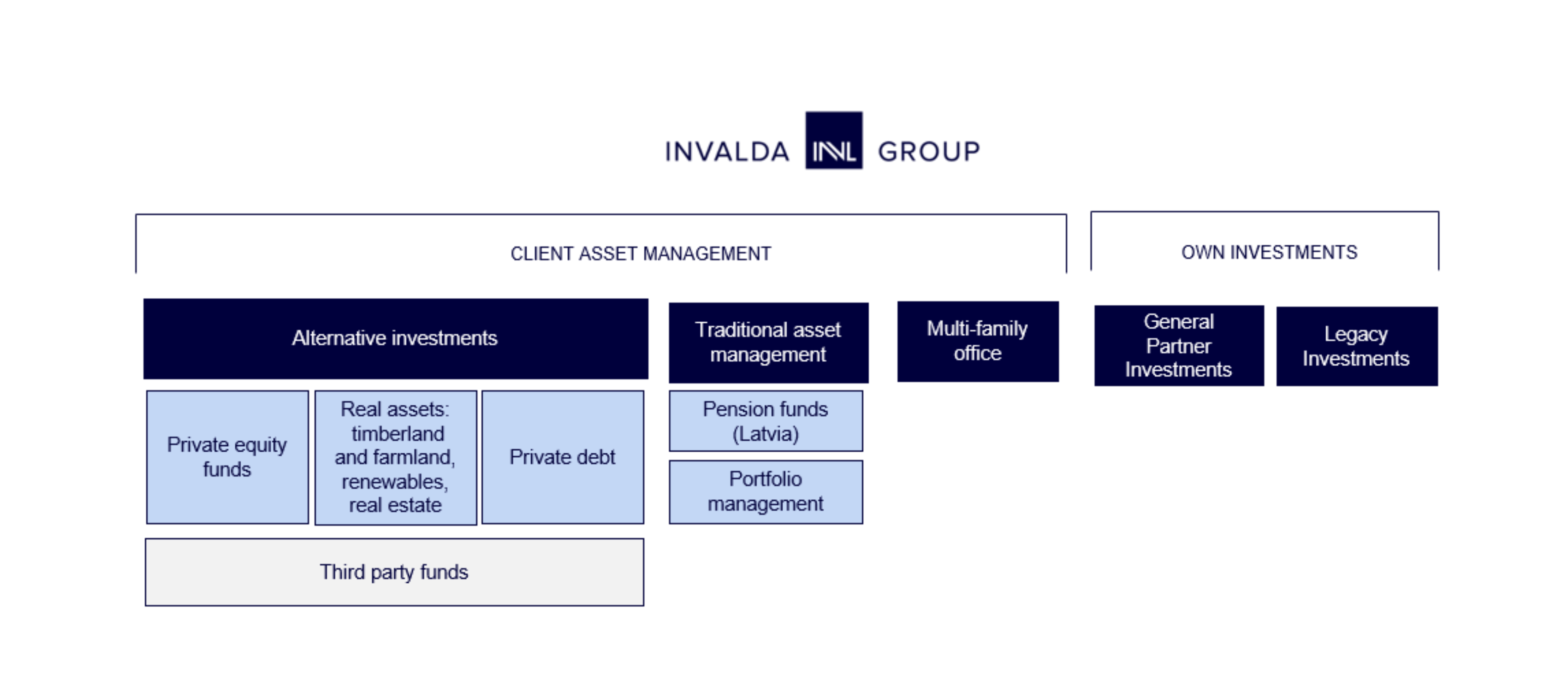

Invalda INVL is the leading Baltic asset management group with an open approach, growing and developing, and creating well-being for people through its activities.

Invalda INVL group manages alternative mutual funds with investments in private equity, real assets and private debt. The group’s companies also provide family office services in Lithuania, Latvia, Estonia, manage pension funds in Latvia and invests in world-class third-party funds.

Founded in 1991, at the dawn of Lithuania’s restoration of independence, Invalda INVL was established by a group of academics to create value and contribute to the country’s economy. We are pioneers in private equity management in the Baltics.

The company has been listed on the stock exchange since 1995. Since then, the share price of Invalda INVL has increased more than 300 times.

For more information please visit Homepage - Invalda INVL

Initiatives

Renkuosi Mokyti

Renkuosi Mokyti (“I Choose to Teach”) is a programme that brings together members of the education community – its own participants and alumni, teachers, schools – to promote positive change in Lithuanian education.

With the aim of enabling change, the programme recruits motivated participants who are geared to helping others to work in schools for two years. After completing the programme, about 75% of participants remain in the field of education and continue their work: as teachers, school leaders, academics or education policy makers.

Not just schools but also businesses are supporting the initiative. The programme seeks to build a community that can help ensure the sustainability of the desired changes.

For more information (in Lithuanian) see: www.renkuosimokyti.lt

Initiative Fund

The Initiative Fund (Iniciatyvos fondas) is a not-for-profit organisation that Invalda INVL established in 2007 to promote socially minded activities and organise programmes for a variety of social groups. The main focus is on boosting knowledge and education levels. Special attention is given to helping integrate people from the most remote areas of Lithuania into a more vibrant community.

The foundation organises large-scale integrated programmes which encourage independent initiative by different groups in society to actively contribute to the economic growth in Lithuania and to a more responsible and harmonious society. The priorities of the Initiative Fund may vary from year to year.

In 2007, the Initiative Fund joined the United Nations Global Compact, which encourages businesses to conduct their strategies and operations in accordance with 10 principles in the areas of human rights, labour, the environment and anti-corruption. The main task of the Global Compact is to encourage and promote corporate social responsibility and fair markets.

For more information, visit www.iniciatyvosfondas.lt.