Upon retirement participants in 2nd pillar pension funds will receive pension from two sources: the accumulated assets in the 2nd pillar pension fund and SODRA. The pension payment procedure depends on how much money you have accumulated in the 2nd pillar pension fund.

Assets from pension funds can be paid out in the following ways:

It is important to know that as long as the assets are in the pension fund (you are accumulating or receiving periodic payments), they are inheritable. When you receive annuity benefits, most of the assets accumulated in the 2nd pillar pension fund can be inherited, depending on the type of annuity you choose.

Unlike the SODRA pension accumulated in the 1st pillar, which cannot be inherited, the assets you have accumulated in 2nd and 3rd pillar pension funds belong to you and may be inherited. The specific inheritable amount depends on how much money you have accumulated and on the form of pension payment you choose, i.e. a standard or deferred annuity. If you choose a deferred annuity, most of the accumulated assets (85-90%) may be inherited.

There is no need to worry about it for a very simple reason. The assets of the pension fund are separated from the company that manages it. So, even if the fund manager goes bankrupt, your money will still be “working” in the fund and will be managed by a new company. The assets are kept in a special depository bank, and pension funds are supervised by the Bank of Lithuania.

Accumulation in 2nd pillar pension funds can protect your money from inflation. If you keep your savings in an account or a “sock”, inflation will simply eat them up. It is also important that long-term pension accumulation has a compound interest effect. With periodic investments, as markets rise, interest-earning assets start growing, so eventually the total amount increases not only from the amount contributed, but also from the interest earned. So the earlier you start accumulating and the longer you do it, the more you save for your retirement. Of course, when you calculate potential future earnings, remember that markets are constantly fluctuating and the value of money is also affected by inflation, which is likely to result in a lower real value of money.

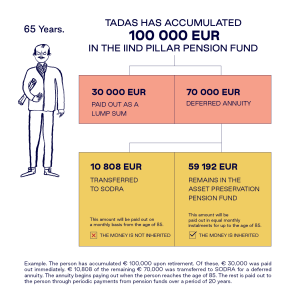

People who have been accumulating for a 2nd pillar pension for a long time are likely to accumulate €10,807–64,841 or more and therefore will have to purchase an annuity.

An annuity is a way of withdrawing the assets accumulated in 2nd pillar pension funds when more than €10,807 has been accumulated. The only annuity provider is SODRA. You will be able to choose from two types of annuity.

With a standard annuity, the entire amount you accumulate is returned to SODRA, and the money is paid out in equal monthly instalments as long as you live. These assets are not inheritable unless you choose an inherited standard annuity with a guaranteed payment period.

If you choose a deferred annuity, most of the accumulated amount (85-90%) remains in the asset retention pension fund (you can choose another pension fund, if you wish), these assets are further invested and paid in equal instalments up to the age of 85, depending on the accumulated fund units. These assets are inheritable. The remaining accumulated amount (10-15%) is transferred to SODRA and is used for paying you a deferred annuity from the age of 85.

We have been steadily working and growing since the launch of the pension system in 2004. Client assets are taken care of by investment professionals with more than 10 years of experience and international recognition – our team are one of the largest and most experienced teams in the region.

We work exclusively with investment, so we pay special attention to your pension funds. This is also proved by our achievements – at the end of 2018, the INVL MEZZO II 53+ fund received the International IPE Award!

You can become an INVL client online – it only takes a few minutes and no need to come to the office. By the way, we provide accumulation reports to our clients even four times a year.

Subscribe to the newsletter and receive useful information on retirement savings and tips on financial management.

By clicking “Subscribe”, you agree to receive INVL Asset Management news and information about our services and products at the e-mail address provided. In accordance with the company’s privacy policy, this data will be stored for one year.

Please remember that for participants in 2nd pillar pension accumulation, the state social insurance retirement pension for the period prior to 31 December 2018 is proportionately reduced as established by law, except for persons participating in pension accumulation prior to 31 December 2018 who between 1 January 2019 and 30 June 2019 exercised their right to terminate pension accumulation – reduction of the state social insurance age-old pension will not apply to such persons. The additional State contribution does not reduce the amount of the retirement pension. A 2nd pillar pension accumulation agreement cannot be terminated, unless it is a first-time agreement, in which case the participant may unilaterally terminate the agreement within 30 calendar days after signing the agreement, by giving written notice to the pension accumulation company. Persons who became participants before 31 December 2018 had the right to terminate their participation in the accumulation of pensions or to suspend the transfer of pension contributions to the pension fund from 1 January 2019 to 30 June 2019.

Participants in accumulation in pension funds assume the investment risk. The pension accumulation company does not guarantee the profitability of pension funds. The value of a pension fund can go both up and down, and you can get back less than you invested. Past performance of a pension fund does not guarantee the same results and profitability in the future. Past performance is not a reliable indicator of future results.

Choose a pension fund responsibly and carefully. Please pay attention to investment risks and applicable deductions. Carefully read the rules of the pension fund, which are an integral part of the pension accumulation agreement.

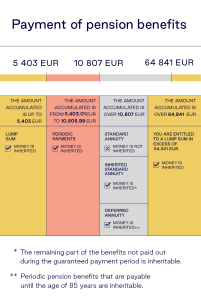

Depending on the amount accumulated in a 2nd pillar pension fund, you can choose a lump sum (where the amount is up to €5,403), periodic payments (where the amount is from €5,403 to €10,807) or a pension annuity (where the amount is from €10,807 to €64,841). In case of a pension annuity, it can be standard, inherited standard or deferred. A standard annuity means that the entire amount accumulated in the fund is spent on the acquisition of the annuity, and pension payments start immediately after you purchase the annuity and continue for the rest of your life. In case of a inherited standard annuity, benefits are also paid as long as you live with a guaranteed payment until the participant reaches the age of 80. If the participant dies earlier, the outstanding amount is inherited. In both cases of a standard annuity, the entire amount accumulated in the fund is spent on the acquisition of the annuity and the benefits are paid by SODRA in addition to the retirement pension paid by the State. A deferred annuity means that benefits are paid from the private pension fund from the time of retirement until the age of 85 (payments are made from the assets left after the acquisition of the deferred annuity) and these assets are inheritable. From the age of 85, benefits are paid by SODRA, but they are not inheritable). If you accumulate more than €64,841, the portion of the assets that exceeds this amount may be paid as a lump sum, and the remaining assets are paid in instalments for the rest of your life in accordance with your type of annuity.

All the information presented is of a promotional nature and cannot be construed as a recommendation, offer or invitation to accumulate assets in pension funds managed by INVL Asset Management. The information provided here cannot serve as a basis for any subsequently concluded agreement. Although this information of a promotional nature is based on sources which are considered to be reliable, INVL Asset Management is not responsible for any inaccuracies or changes in the information, or for any losses that may incur when investments are based on this information.

![]()

INVL and Šiaulių bankas merged their retail services as of 1 December 2023.

Please select Your topic on SB.lt webpage.

![]()

INVL and Šiaulių bankas merged their retail services as of 1 December 2023.